Managing loans is a critical part of personal finance. Whether it’s a personal loan, home loan, or any other type of borrowing, keeping track of repayments and outstanding balances is essential to stay financially healthy. With Balance: Money Manager, you can easily add loans, track your repayments, and get insights into your overall financial status.

In this guide, we’ll show you how to add and manage loans using Balance: Money Manager.

Why Track Loans in Balance: Money Manager?

Tracking loans helps you:

- Stay updated on outstanding balances.

- Plan repayments effectively

- Avoid missed payments

- Get a clearer picture of your net worth.

By adding loans in Balance: Money Manager, you can integrate your liabilities into your overall financial plan and make informed decisions

How to Add a Loan in Balance: Money Manager

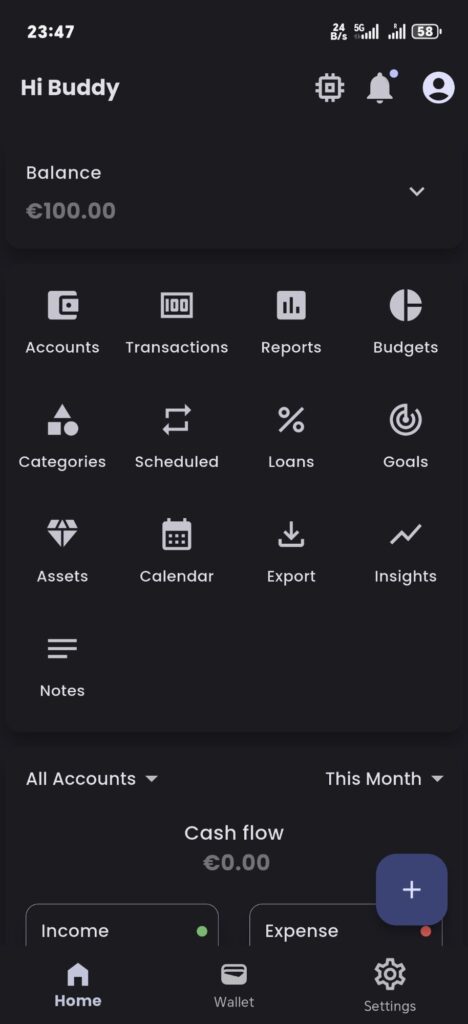

Step 1: Open the App

Log in to your Balance: Money Manager account.

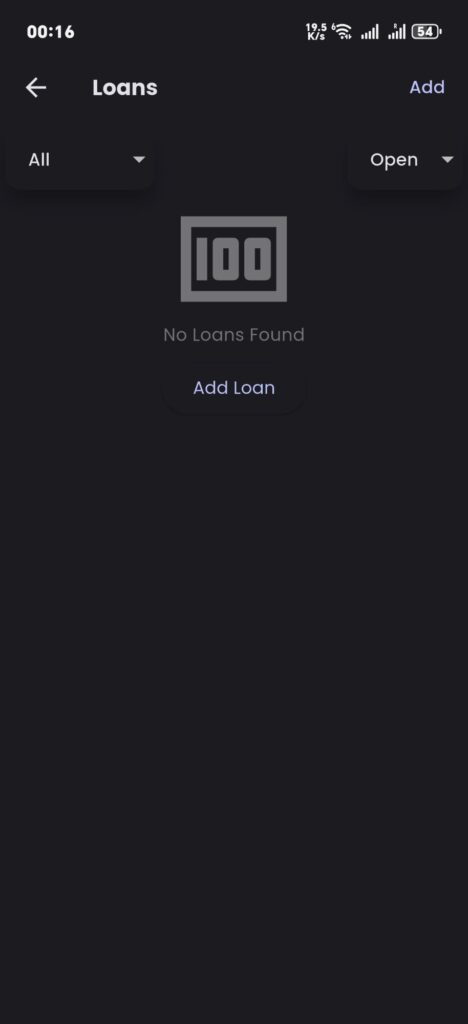

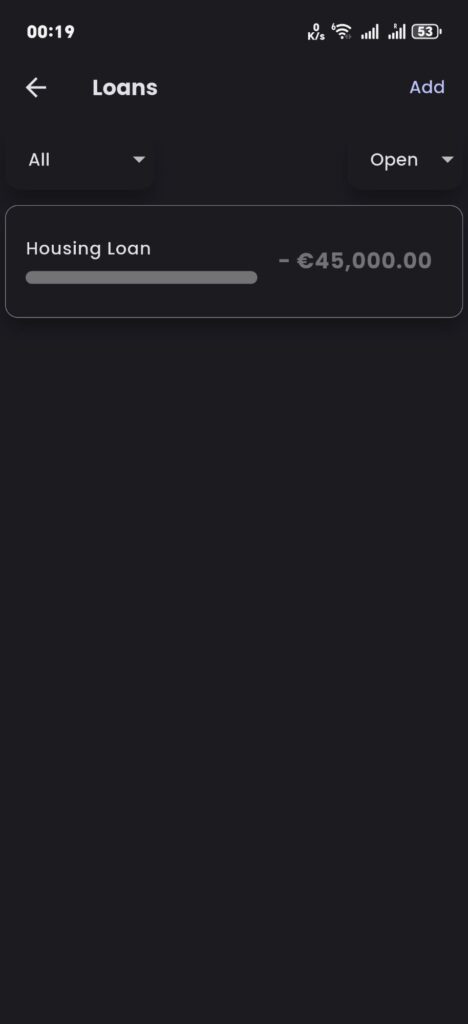

Step 2: Navigate to the Loans Section

- Go to Accounts or Loans from the main dashboard

- Tap on Add Loan

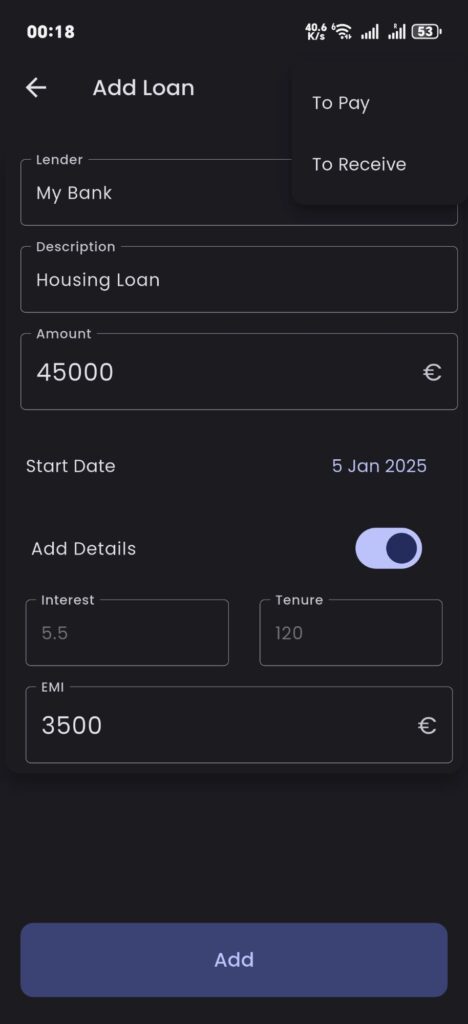

Step 3: Enter Loan Details

- Loan Type – Select type of loan to add ( To Pay or To Receive).

- Lender/Borrower – Enter a name for the loan lender (e.g., Bank).

- Loan Description – Enter a description for the loan (e.g., Car Loan, Personal Loan).

- Loan Amount – Enter the total loan amount

- Interest Rate – (Optional) Add the interest rate for accurate tracking.

- Start Date – Set the due date for repayment

- Loan Tenure – Number of months for EMI

- Loan EMI – Monthly EMI for Loan

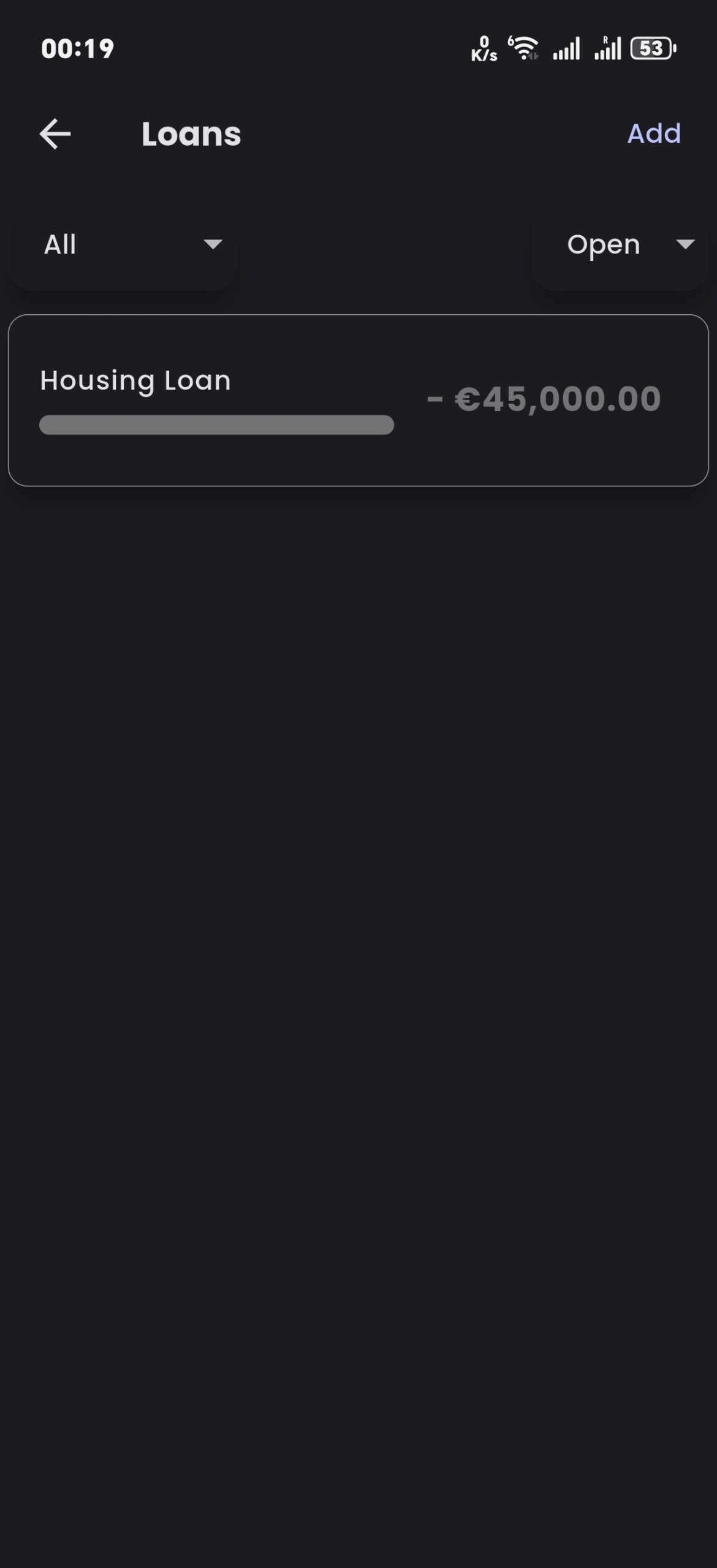

Step 4: Save and Track Your Loan

After entering the details, tap Add. Your loan will now appear in the loans section of the app.

Tracking Loan Repayments

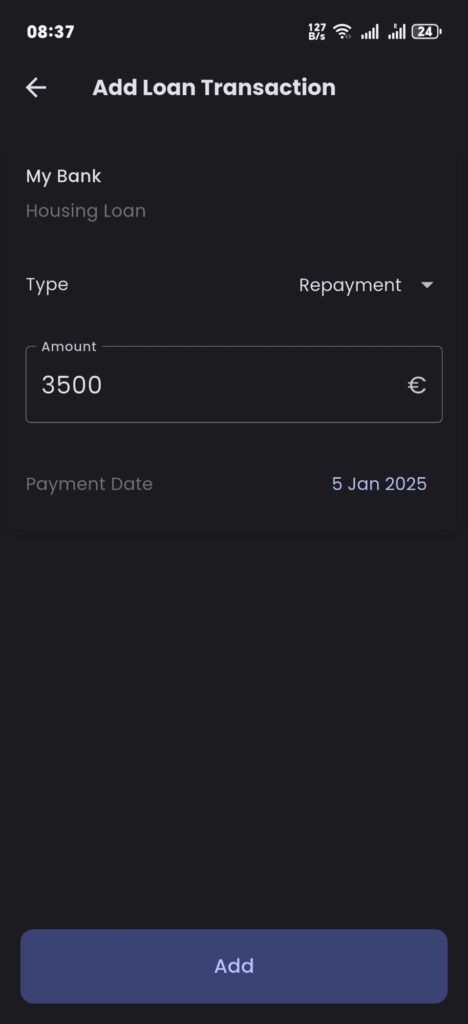

- Go to your loan account

- Tap Add Transaction when you make a repayment

- Enter the repayment amount and date

- The outstanding balance will automatically update

Benefits of Tracking Loans in Balance: Money Manager

- Stay on top of your debts.

- Reduce financial stress by planning repayments.

- Gain a holistic view of your finances, including both assets and liabilities.

Conclusion

Adding and tracking loans in Balance: Money Manager helps you manage your finances effectively. Stay organized, avoid missed payments, and reduce your debt over time by making the most of this feature.

Start tracking your loans today and take control of your financial journey!